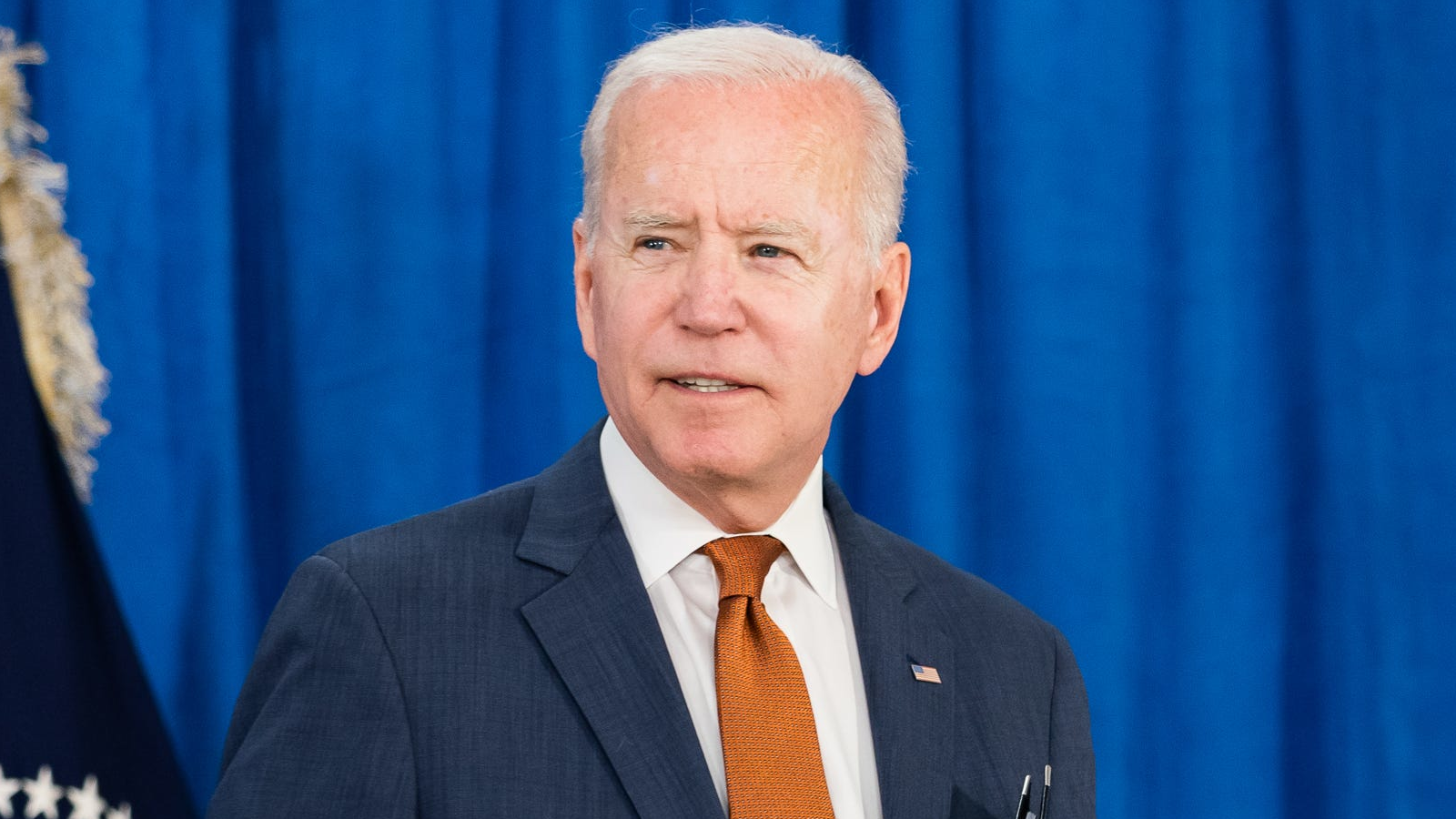

President Biden’s unveiling of his ambitious fiscal year 2025 budget proposal has sparked intense debate, as it pitches $5.5 trillion in tax increases targeted at the wealthy and corporations, a move that conservatives argue could stifle economic growth and innovation. The proposed tax hikes are set to fund a swath of federal programs, including affordable housing, student debt cancellation, and an expansion of federal benefit programs.

This election-year budget proposition faces steep opposition in Congress, particularly from conservative lawmakers who prioritize tax cuts and reduced government spending. The President’s budget matches the previous year’s proposed tax increase, yet it claims to shrink the federal deficit by $3 trillion over a decade—an assertion met with skepticism from fiscal conservatives who question the feasibility of such projections.

Critics within the MAGA movement and the broader conservative community are likely to challenge the budget’s reliance on increased taxation rather than spending cuts as a means to deficit reduction. They argue that such an approach could place undue burdens on the economic engines of America, potentially dampening the investment climate and hindering job creation.

The proposal sets the stage for a contentious political showdown over fiscal priorities, with conservatives poised to push back against what they see as a progressive agenda that favors increased government intervention over free-market solutions. As the nation gears up for another election cycle, the debate over Biden’s budget is expected to intensify, highlighting the ideological divide between those advocating for a leaner government footprint and those calling for expanded government investment in social programs.