The entrance of Trump Media, trading as DJT on NASDAQ, into the stock market has been nothing short of a spectacle, mirroring the flamboyant nature of its founder.

With a staggering 50% jump post-listing, DJT has captivated both supporters and skeptics, prompting a critical examination of its investment viability.

At the heart of Trump Media’s portfolio is Truth Social, a platform that positions itself as a bastion of free speech and a counterbalance to mainstream social media giants.

Despite generating a modest $3.3 million in revenue for the first nine months of 2023 and recording a $49 million loss, Trump Media’s market valuation skyrocketed to nearly $8 billion post-trading.

This valuation is nearly 2,000 times its estimated annual revenue, a figure that starkly contrasts with the price-to-sales ratios of established players like Reddit (10), Meta (7), and Snap (6).

Such a valuation places Trump Media in the realm of “meme stocks,” akin to GameStop and AMC, which saw their values driven more by retail investor sentiment than traditional financial metrics.

This phenomenon underscores a vital consideration for potential investors: the stock’s performance is heavily influenced by speculative trading and political support rather than underlying financial health.

Trump Media’s user engagement metrics offer further insights.

Donate To IV Times Today!

Truth Social’s app has seen 10 million downloads since its launch, with 5 million desktop and mobile visitors last month.

While these figures surpass those of similar alternative platforms, they pale in comparison to the behemoths of social media, with Facebook boasting three billion monthly active users.

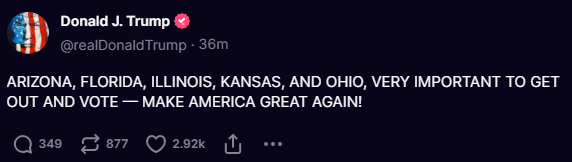

The stock’s buyer demographic is predominantly individual investors, many of whom view their investment as a show of support for former President Trump and his vision of free speech on social media.

This emotional and political investment rationale adds another layer of volatility, as it may not align with traditional investment strategies focused on financial fundamentals.

For investors considering DJT, it’s essential to weigh the speculative nature of this investment against its potential for long-term growth.

The platform’s political and cultural significance, combined with Trump’s personal brand, could indeed drive user growth and revenue.

However, the company’s current financials and the speculative nature of its stock price suggest a high-risk investment.

In summary, investing in DJT requires a careful analysis of one’s risk tolerance and investment goals.

While there’s undeniable excitement around Trump Media’s entry into the stock market, the company’s long-term viability and path to profitability remain uncertain.

Potential investors should consider these factors, along with the broader market’s appetite for politically charged investments, before making a decision.